Funk Smart BI Check provides clarity

In a world of connected supply chains, business interruptions can result in significant financial damages. The management should therefore be aware of the worst case and obtain protection with a business interruption insurance based on needs. The market for the corresponding insurances has hardened, creating additional challenges.

The poor claim rates of recent years have placed property insurers in a tight spot. As a result, general hardening in the property insurance market with a slight increase in premiums has been observed. But particularly after a claim and/or in certain industries such as chemicals and meat products, there have also been much higher increases in premiums. In some cases, two to three times the existing premiums have been demanded, while in others, insurers have even wanted to terminate the insurance cover entirely. Dr Alexander Skorna, Head of Business Development at Funk, adds: ‘Much lower limits for retroactive and reciprocal effects as well as capacities per individual risk through insurers have also proven to be problematic for policy holders. As a result, insurance cover is not only more expensive in individual cases, but also offers less scope of cover.’

The insurer Allianz/AGCS names the risk of business interruption as one of the most important risks for companies worldwide in 2020. Traditional risks such as fire or explosion are still the most common cause, but risks such as civil unrest or risks due to digital supply chains are also gaining in importance. Irrespective of the cause, the costs of business interruptions contribute significantly to the total damage. According to the AGCS, the average BI loss under a property insurance policy amounts to more than EUR 5.8 million. This is around 45 percent more than the average direct property damage – which amounts to EUR 4 million.

- Globally integrated supply chains with limited buffer stock and redundancies

- Streamlining know-how and individual working steps to a few key works without improvements to fire protection or crisis management

- Increasing dependence on IT infrastructures, which are constantly exposed to many different forms of attack.

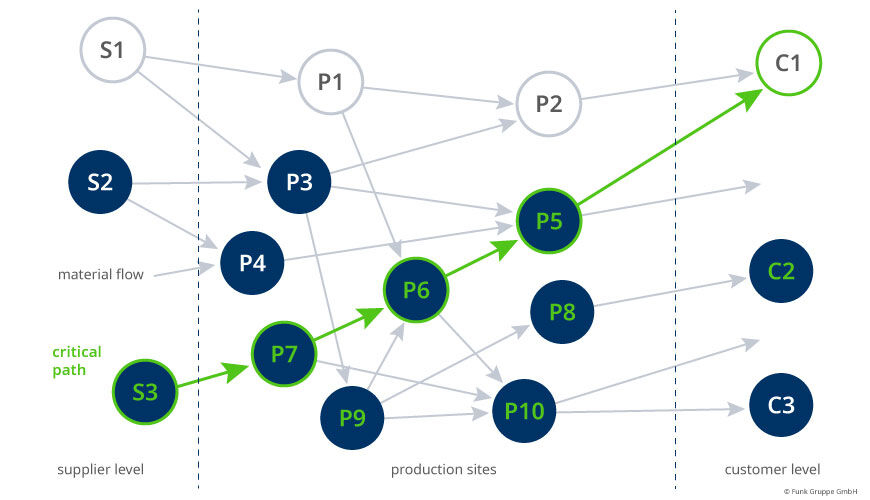

Funk Smart BI Check for greater transparency in supply chain risks

While companies tend to have a handle on the values of their buildings, machinery, systems and supplies, localising gross profits on a production site or complex level is often difficult. Because value chains are now connected, determining the internal and external interdependencies is also important. ‘This is the only way to efficiently define the scope of insurance,’ says Fabian Konopka, Consultant for BI and Business Continuity Management at Funk Risk Consulting. Funk Risk Consulting works with the company to analyse its value-adding processes. Based on scenarios, a qualified risk dialogue reveals the maximum losses that are financially likely as a result of the failure of critical suppliers, production locations and bottleneck systems as well as critical customers. ‘We take a look at the manufacturing systems on-site, carry out risk dialogues and, on this basis, analyse interdependencies and risks,’ explains Fabian Konopka.

This provides companies with clarity about the worst case. Dr Skorna adds: ‘A decisive secondary effect is also the supportive marketability of the property/business interruption risk. In a hard property insurance market, transparency in actual risk represents major added value when it comes to finding a suitable risk carrier and attractive premium level. The sums insured can also be reduced on occasion, as companies are sometimes designed specifically to be more redundant due to their expansion. We’ve also increasingly observed the trend of insurers only expanding the scope of cover – for instance, higher limits/sums insured – after completing analysis of business interruption.’