The mechanical and systems engineering sector is increasingly evolving into a provider of digital solutions. Innovative risk solutions can provide substantial support for new product and service strategies. In a white paper that brings together cross-industry knowledge of business model transformation, risk management and mechanical engineering insurance, Funk and reinsurer Munich Re outline in greater detail how such solutions can help.

Many SMEs in the mechanical and systems engineering sector are already making headway with digitalisation. Analogue machinery providers are evolving into digital solution suppliers that are integrated more closely within their customers’ value chains. In order to arrive at this point, suppliers are fitting machinery and systems with technologies from the Industrial Internet of Things (IIoT). The machines are becoming smart, which in turn facilitates new business models, generates new sources of revenue and thus boosts a company’s future viability. End customers, however, are often still sceptical about the technological opportunities and new business models afforded by digitalisation in mechanical and systems engineering. In order to gain the trust of customers, providers will need to bear the majority of the customer and operator risks. Some of them are already pursuing this approach, but the concentration of risk increases with each new customer. Risk solutions and insurance for mechanical engineering can help in this regard.

How does Funk support digitalisation in mechanical engineering?

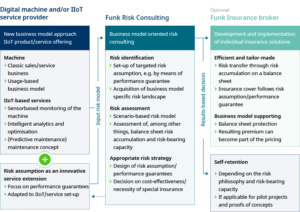

Anyone aiming to ensure performance criteria within an IIoT-based business model and thereby relieve their customers of specific risks needs to consider the impacts on their own risk situation from the outset. For mechanical and systems engineering firms, the following question is pivotal when it comes to their own risk-bearing capability: how does any extension of your own service promise (e.g. by means of a performance warranty) affect your own risk situation and balance sheet? With this identifiable knowledge, which can be tested using a scenario-based risk model, suppliers can, first of all, strike the optimum balance in terms of accepting risks vis-à-vis end customers in the form of contractual warranties, etc. Secondly, it also makes it possible to take sound decisions on the necessity and cost-effectiveness of bespoke insurance for the mechanical engineering sector.

As a provider of risk management solutions, Funk supports you in this process from start to finish: with our Business Model Risk Assessment (BMRA), we offer you a modular advisory solution (see chart below). As part of this solution, we assist you with the risk-based structuring of your business model, evaluate all impacts using a bespoke risk model and thus put you in a position to take a sound decision about an optimum risk strategy. If, in this regard, it becomes clear that a risk transfer via a bespoke insurance solution makes economic sense, Funk will, on request, also provide this in its capacity as a broker, meaning that digitalisation in mechanical engineering can be delivered safely.

White paper on risk solutions and insurance in mechanical engineering

In their white paper, Manuel Zimmermann, Beyond Insurance Manager at Funk, and Roman Boos, Senior Underwriter at Munich Re, explore the opportunities and resulting risks associated with digitalised product/service solutions in the mechanical and systems engineering sectors. They explain how innovative insurance policies for mechanical engineering can facilitate the implementation and scaling of technology- and service-driven business models and significantly support sales. We will be happy to provide you with the white paper on digitalisation in mechanical engineering as a PDF.