W&I insurance as a strategic advantage for Chinese investors in M&A transactions

For Chinese investors, M&A investments offer great opportunities, but turning them into long-term successes can be a great challenge. Two Funk experts show how W&I insurance can be a useful strategic instrument.

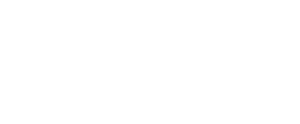

Despite rising global protectionism, outbound M&A investments by Chinese corporations are still expected to show substantial growth over the next years.[1] Studies project that Chinese outbound direct investments will total USD 1.5 trillion to USD 2.5 trillion over the next 10 years.[2] Although the overall volume of China’s outward direct investments has been decreasing since 2016, there are emerging signs of dynamism. In 2019, such deals still totalled USD 117 billion. A specific focus for Chinese investors is being put on Europe, where Chinese Foreign Direct Investments (FDI) grew substantially throughout the last decade:

Figure 1: Cumulative value of Chinese FDI transactions in the EU by country, 2000-2019. Rhodium Group/MERICS.

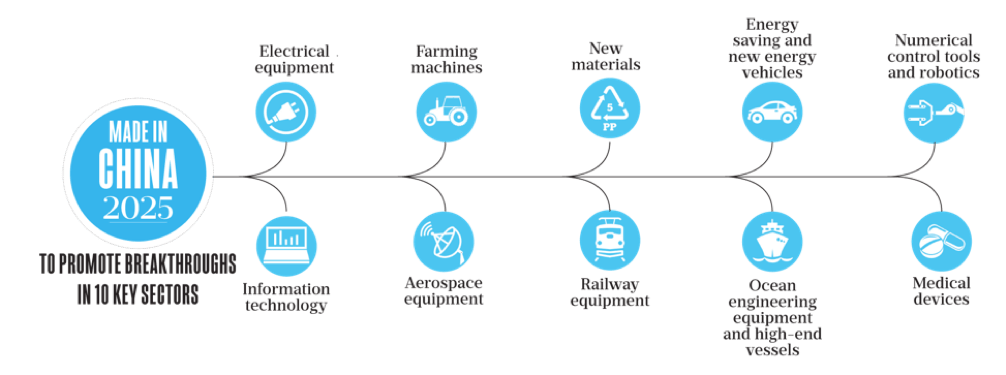

Among the EU countries at which those investments were directed in the period from 2000 to 2019, the UK and Germany are ranked first and second. Chinese regulators are anticipated to continue to provide a supportive political and financing environment for acquisitions that are aligned with China’s “Go Global” strategy and “Made in China 2025” policy, which aim for Chinese companies to become global technological leaders in 10 key industries.[3]

Figure 2: China’s Goals. One Road Research. Peter Pham: What Will China’s Future Look Like? Forbes Media LLC. Mar 7, 2018

In addition, China’s “Belt and Road Initiative”, the ambitious plan to build links between Asia, Europe and Africa covering more than 70 countries, is predicted to be an increasing driver of Chinese outbound investment deals. Its focus is on infrastructure, energy and transportation.

For Chinese investors, acquisitions of foreign companies offer great opportunities. At the same time, closing deals and turning M&A investments into long-term successes has proven to entail significant challenges for Chinese investors. M&A related insurances can help to mitigate the risks associated with such a cross-border M&A investment. The cornerstone of a successful M&A activity is Warranty and Indemnity (W&I) insurance.[4] For Chinese investors, W&I insurance is particularly interesting as a strategic instrument that adds value beyond the immediate financial protection of the insurance coverage.

W&I insurance – transferring liability risks

W&I insurance covers breaches of representations, warranties or certain indemnities (including the tax covenant) given by the seller to the buyer in a Sale and Purchase Agreement (SPA). The insurance protection covers loss or liability arising from unknown or undisclosed matters and provides indemnity for financial loss. Each W&I insurance policy is tailored to meet the specific needs of the respective M&A transaction. Policyholder of the W&I insurance can either be the seller (Sell-Side-Insurance) or the buyer (Buy-Side-Insurance). In the current market, W&I insurance is almost exclusively taken out by the buyer. The following article therefore focuses on the scenario of the Buy-Side-Insurance.

Considering the global W&I insurance market, there is a fierce competition of a number of W&I insurers which has driven price reduction, coverage enhancement and genuine innovation over the past few years. The European market still has not come up to the same claims frequency and volume like the US. As a result, insurance premiums in the European market are considerably lower than in the US market. In Europe, the warranties that are most likely to be breached relate to financial statements, compliance with laws and material contracts. Even though W&I insurance is not widely known within China, the number of both inquiries and uptakes of W&I insurance increases strongly for insuring outbound M&A activities of Chinese buyers. However, for the moment W&I insurance is predominantly bought by Chinese investors for outbound investments and not for domestic M&A transactions inside of China.

Win-win situation for seller and buyer

The seller retains a post-closing liability for any breach of a representation, warranty or indemnity under the SPA. The buyer usually requests that a proportion of the purchase price is being placed into an escrow account to cover potential claims. The key advantage of W&I insurance to the seller is that he can limit (or eliminate) this liability. The insurer effectively „steps into the shoes” of the seller. This allows the seller to retain funds flowing from the transaction with little to no „tail of liability“ and without the need of an escrow („clean exit“). The insurer can take recourse against the seller only in case of an intentionally or grossly neglected breach. The seller – whether a private equity fund, private person or corporation – therefore will often demand that a W&I insurance is utilised. In today’s seller-friendly M&A market, it is not rare that sellers request a W&I insurance as a condition of the transaction.

For the buyer, W&I insurance might be the only realistic option in the current seller market to obtain a substantial warranty. While the seller realises a clean exit, the insurer still provides warranties to the buyer. Furthermore, the W&I policy can extend the duration and amount of the warranty compared to what typically can be obtained from the seller. This provides the buyer with additional time to detect and report problems that may exist within the acquired target company. In case of a claim, the insurer is a professional and solvent respondent. The buyer can avoid compensation collection issues when multiple and/or foreign sellers are involved. All these considerations are crucial for the long-term success of buyer’s investment. Agreeing to a transaction in which the seller provides none or only very limited warranties means substantial risks for the buyer. A warranty that cannot be properly enforced in case of a claim would prove meritless and cause severe loss for the buyer. Additionally, W&I insurance is helpful in the context in which the buyer gains no benefit from suing the seller (e.g. when the seller remains a key employee in the target company or becomes a business partner), as the insurer is subject to the liability in this case.

Chinese government enforces risk management measures

Starting in 2017, the Chinese government began to put outbound investments under more scrutiny. State-owned enterprises have been encouraged to utilise appropriate instruments to mitigate the financial risks associated with outbound transactions. In June 2017, a directive on management measures of outbound investments of state-owned enterprises was released.[5] Furthermore, the Chinese government clearly states that decision makers of companies going abroad have to be held personally responsible for the success of outbound investments, in case they neglect their management duties or do not abide the existing rules and regulations.

It is generally known that successfully closing an M&A transaction that involves Chinese buyers often requires more time than closing a transaction with a western buyer. Reasons are regulatory hurdles both in China and the target country as well as long and complex internal decision-making procedures in Chinese corporations. However, M&A transactions are usually time-critical. Those characteristics put Chinese investors in a decisive disadvantage compared to other prospective buyers. W&I insurance can help the Chinese investor to turn the tables by “sweetening the bid”.

There is also a strong incentive for the Chinese buyer to proactively offer W&I insurance to the seller, as W&I insurance can not only reduce the liabilities of both the buyer and the seller but also help to come across deal-breakers. Thus, when the seller and buyer cannot come to an agreement on the terms of the warranties and indemnities – facing the risk of failing the entire transaction – W&I Insurance can help to “bridge the gap”. Employing a W&I insurance further simplifies and expedites the entire negotiation between the parties, as warranties and indemnities usually are among the most discussed issues of an M&A transaction.

W&I insurance for unknown risks

However, W&I insurance cannot solve all problems that arise in an M&A transaction. It is conceptually designed to cover unexpected and unknown risks inherent to the transaction target – keeping in mind that insurers by nature do not underwrite irrational and unassessed risks. Insurers require that a buyer who seeks insurance cover has undertaken a legal due diligence review of the target in accordance with market practice. Therefore, W&I insurance is not a substitute for conducting a thorough and comprehensive due diligence. Risks associated with areas that have not been subject to due diligence are typically excluded from coverage under a W&I policy. The scope of the due diligence is therefore fundamental to making an M&A transaction “insurable”.

Special risk policies for identified risks

While disclosed or known risks are typically excluded from a W&I policy, these can be insured through so-called special risk policies:

- Tax indemnity insurance indemnifies the policy holder against potential tax liabilities that have been identified in the due diligence. These liabilities can arise for instance from the uncertainty of having selected the correct VAT for a specific property or from the tax treatment of the transaction.

- Litigation buy-out insurance indemnifies the policy holder from uncertainties inherent in any current or anticipated litigation, arbitration or other legal dispute in which a target company is involved at the time of the acquisition.

- Environmental risk insurance indemnifies the policy holder against environmental pollution. This risk often arises in real-estate transactions and acquisitions of corporations with manufacturing sites. While the W&I policy typically covers the matter in environmental law, such as the risk that the target company does not possess the required permits, it often excludes pollution and the clean-up of the property.

- Title insurance covers risks surrounding title to assets or shares. While historically primarily used in real estate transactions, policies are now also used in operational transactions, especially where real estate is a crucial factor of the target company’s value or where the covenant strength of a seller is questioned.

Obtaining comprehensive and cost-efficient coverage

In order to obtain comprehensive and cost-efficient insurance coverage for the risks associated with an M&A transaction, a call for a tender including the relevant players in the W&I insurance market should be launched. As a result, quotes from multiple insurers have to be compared and evaluated. Given the complexity of this task, investors often engage an international insurance broker who has access to a wide range of insurers, analyses the offered insurance coverages against the proposed premiums and provides a comprehensive summary report, the so-called Non-Binding-Indication (NBI). The insurance broker furthermore can provide a flexible, fast and professional risk assessment that is tailored to the specific M&A transaction. In addition, the investor can profit from the rich experience and insights that the broker has gained in the transaction market.

Where is the demarcation line between W&I insurance and insurance due diligence?

As described above, a large number of transactional risks can be covered by means of a W&I insurance. Conducting a comprehensive legal due diligence is an important prerequisite for ensuring full coverage under W&I insurance. Does this imply undergoing a specific insurance due diligence is no longer necessary? The prudent buyer thrives to avoid surprises of any kind once he acquires ownership. He tries not only to identify insurance gaps but also to get a realistic evaluation of the seller’s risk situation, e.g. learning from paid, incurred and reported claims or serious risk management problems which require further investments such as a required yet not-installed sprinkler system in the factory. As a consequence, a comprehensive insurance due diligence report can help the buyer in decision-making – requesting for further warranties or reductions in the purchasing price of the target company. In addition, some risks unveiled through insurance due diligence can even be included into the W&I insurance coverage. Therefore, an insurance due diligence report plays a vital role in securing the buyer’s financial position. Accordingly, insurance due diligence and W&I insurance are supposed to go hand in hand in each and every M&A transaction to secure a competitive advantage for the buyer.

Navigating the risks of an M&A transaction

W&I Insurance has become popular over the past years, because it allows both the seller and the buyer to mitigate risks that are directly associated with an M&A transaction. For Chinese investors, comprehensive risk coverage is crucial to fulfilling the government’s requirement to better control the risks of outbound investments. In addition, a W&I policy can be an important competitive advantage to outweigh reservations of western sellers about entering a transaction with a Chinese buyer. The advantages of a W&I Insurance can further be supplemented by the range of special risk insurances that can be tailored to provide a comprehensive M&A insurance solution for a cross-border M&A transaction.

Author:

Dr. Stephan Kuntner (孔劭凡博士) is the Executive Director of the Funk China Division. Together with his team, he is responsible for comprehensive insurance and risk management solutions for Chinese outbound direct investments. He advises Chinese investors on insuring M&A transaction-related risks, with a special focus on W&I insurance.

Prior to joining Funk, he has worked for more than three years in the Shanghai office of an international law firm. He has advised multinational corporations on M&A transactions, corporate restructuring and foreign direct investments in China. Before that, he has worked in the corporate law department of an international law firm in Hamburg, Germany. Stephan Kuntner holds a law degree from Bucerius Law School in Hamburg, Germany, and has studied Chinese law at the Law Institute of the Chinese Academy of Social Science in Beijing. Following his law degree, he studied Chinese for one year at Nanjing University. In his PhD thesis, Stephan analysed and compared Chinese and German corporate law.

[1] https://www.ft.com/content/ed2a4a16-2db6-11e8-9b4b-bc4b9f08f381 (accessed 27.12.2020)

[2] https://www.ft.com/content/ed2a4a16-2db6-11e8-9b4b-bc4b9f08f381 (accessed 27.12.2020)

[3] For a detailed analysis of the China 2025 policy, see https://www.merics.org/sites/default/files/2017-09/MPOC_No.2_MadeinChina2025.pdf (accessed 27.12.2020)

[4] W&I Insurance is the common term used in the UK and Europe, while it is referred to as Representation and Warranty (R&W) Insurance in the US.

[5] http://www.mof.gov.cn/gp/xxgkml/zcgls/201708/t20170802_2664315.html